ri tax rate on unemployment benefits

For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. 1 Unemployment Insurance 2 Job Development Fund and 3 Temporary Disability Tax.

How Do Unemployment Benefits Affect The Economy Quora

UI tax rates are calculated using a statutory formula based on the balance of the states employment security fund.

. Unemployment benefits are normally subject to both federal and Rhode Island personal income tax but on March 11 federal lawmakers passed legislation allowing most taxpayers to deduct the first. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. The states SUTA wage base is 7000 per employee.

30 computation date Moving the computation date is to avoid assessing higher unemployment tax rates for 2022 Rhode Island is to delay the computation date used in unemployment tax calculations for 2022 under an executive order signed Oct. Employer SUI tax unit to be transferred back to the Rhode Island Department of Labor and Training. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes.

Most employers receive a maximum credit of up to 54 against this FUTA tax for allowable state unemployment tax. The job development fund JDF tax rate remained at 021 for 2021. The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers.

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. Rhode Island unemployment insurance UI tax at a glance 2020 2021 Taxable wage base 24000 24600 Tax rate schedule F H Tax rate range 069 to 919 099 to 959 Tax rate ranges do not include the 021 assessment for the Job Development Fund which is the same for 2021 as it was for 2020. UI provides temporary income support to workers who have lost their jobs through no fault of their own and have earned enough wages within a specific base period to qualify.

Because of the high. In recent years the employment security tax component generally has been around 275 and the job development tax component between roughly 2 and 5. Besides the state income tax The Ocean State has three additional state payroll taxes administered by the Division of Taxation.

The form will show the amount of unemployment compensation you received during 2021 and any federal. The rates range from 375 to 599. Unemployment tax rates are calculated every year using.

For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100. Normally unemployment benefits are subject to both federal and Rhode Island personal income tax. Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment benefits in 2020 and the taxpayers federal adjusted gross income AGI was less than 150000 for.

For information on reporting UI fraud. 7031 Koll Center Pkwy Pleasanton CA 94566. WPRI Any Rhode Islanders who received unemployment benefits during 2020 will have to pay state taxes on them.

Generally states have a range of unemployment tax rates for established employers. Since your business has. Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers.

This will also be mailed to claimants. For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with 23000 for 2018 an increase of 600 or 261 percent. The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers.

Unemployment benefits are. The rate for new employers will be 119. Mar 29 2021 0655 PM EDT.

Will be transferred back to the DLT. 52 rows Most states send employers a new SUTA tax rate each year. The FUTA tax is 6 on the first 7000 of income for each employee.

Up to 25 cash back The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next. For example the SUTA tax rates in. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

For all unemployment claimants that received benefits in 2021 the 1099-G form is now available to download on the DLT website. Unemployment insurance payments are taxable income. The tax breakdown can be found on the Rhode Island Department of Revenue website.

For new claims with an effective date of July 4 2021 or later the maximum. Your state will assign you a rate within this range. The rate for new employers will be 116 percent including the 021 percent Job Development Assessment.

Consequently the effective rate works out to 06. Rhode Island is to use a Nov. - Today the Department of Labor and Training announced new maximum weekly benefit amounts for the two major income support programs it runs for Rhode Island workers and employers Unemployment Insurance UI and Temporary Disability Insurance TDI.

The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Employers pay an assessment of 021 to support the Rhode Island Governors Workforce Board as well as employment services and unemployment insurance activities.

Job Development Fund Tax. That means employers whose rates now range from 12 to 98 will see their rates remain steady. The Rhode Island Division of Taxation announced that after many years the Employer Tax Unit which handles the tax side of the UI program.

Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

How Do Unemployment Benefits Affect The Economy Quora

Unemployment Benefits Comparison By State Fileunemployment Org

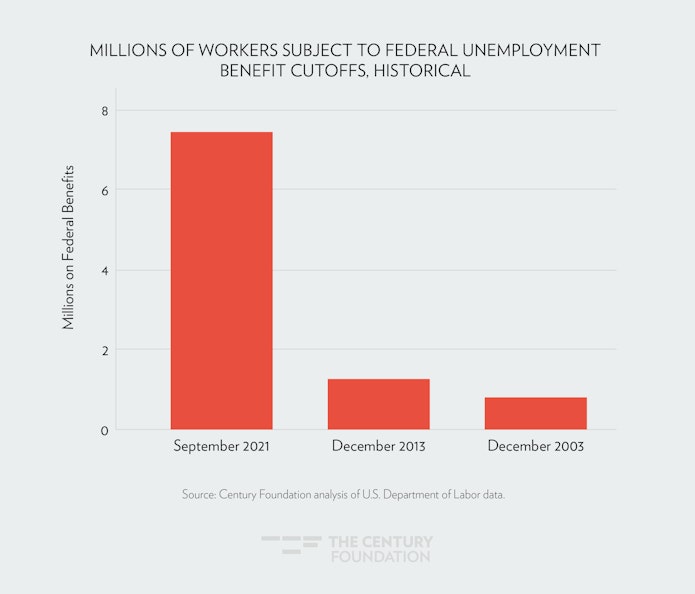

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022 Providence Business News

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

The Effect Of The Regional Income Tax Withholding Allowance And Social Security Premium Support Programmes On Labour Outcomes In Turkey

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved